Many businesses start off with QuickBooks as their accounting system and are normally fine for a few years. Then the organization begins to expand, and sometimes experiences growing pains due to limited core functionality within QuickBooks.

This dilemma often prompts QuickBooks users to look outside of the core product to supplement the add-on functionality they need, such as intercompany processing, or worse, perform the processes manually in another system such as Excel.

What if QuickBooks is Working?

The purpose of this guide isn’t to convince you to leave QuickBooks. In fact, QuickBooks might remain the best system for your business for many years. The purpose of the guide is to help you understand when it’s time to move to a more robust ERP system, like NetSuite, to manage your business.

Both QuickBooks and NetSuite offer software designed to help businesses manage their accounting processes, but there is a significant gap in the depth of features. Below, we discuss QuickBooks vs. NetSuite and compare each platform so business leaders can decide which accounting solution will meet their needs now and for the long run.

Why NetSuite?

NetSuite reaches far beyond basic accounting functionality and adds ecommerce, CRM and a host of other capabilities, but for the purposes of this comparison, we’re going to focus primarily on accounting functionality.

Before we dive into a comparison of the two systems, let’s take a quick look at NetSuite, as most business owners are already familiar with the highly popular QuickBooks.

We’re With You Through Each Stage

Table of Contents

Click on any chapter to jump right to it.

-1-

What is NetSuite?

NetSuite is a suite of cloud-based business management applications that includes much more than full-featured accounting functionality and tremendous customization capabilities. “Cloud based” means you need no internal infrastructure other than a web browser and internet access. There’s no capital outlay for servers or equipment, or operating expenses to maintain that equipment.

In addition to accounting functionality, NetSuite offers a full CRM system, fundraising capabilities and grant tracking for nonprofit organizations, eCommerce web stores, warehouse management, multicurrency, intercompany, consolidated reporting and so forth.

NetSuite is highly customizable. Need a new screen in NetSuite to track tenant lease details? Need a new field on a sales order? No problem.

Businesses using NetSuite don’t need to manage multiple systems or applications as they do with QuickBooks. You simply add and turn on the functionality if and when you need it—and when you turn a feature on, that new feature is immediately connected to the rest of your data.

How to Customize Forms and Fields in NetSuite

The ability to add custom fields and forms is just one reason NetSuite is the world's #1 ERP system. In this blog post, explore how this feature can enhance your organization's processes.

-2-

NetSuite vs. QuickBooks: An Overview

QuickBooks suits some small businesses because it accommodates bookkeeping: managing invoices, paying bills and basic cash flow tracking. When bookkeeping is all that’s needed and accounting demands are minimal, generating month and year-end reports and helping with annual business taxes is enough, QuickBooks may be a fit.

QuickBooks may check off many boxes when it comes to your standard bookkeeping, but NetSuite offers a complete financial management solution that increases efficiency and often reduces the need to hire more accounting staff as your business’s financial needs become more varied and complex. More than just a collection of accounting information, NetSuite comes with preconfigured KPIs, workflows, reminders and customizable dashboards that show exactly how operations and accounting processes align and what needs to get done.

Simply put, NetSuite is much more than an accounting system.

NetSuite also combines core finance and accounting functions with compliance management. With real-time access to financial data, you can drill into details to quickly generate statements and disclosures that comply with multiple financial regulatory requirements, including ASC 606, GAAP, SOX and more.

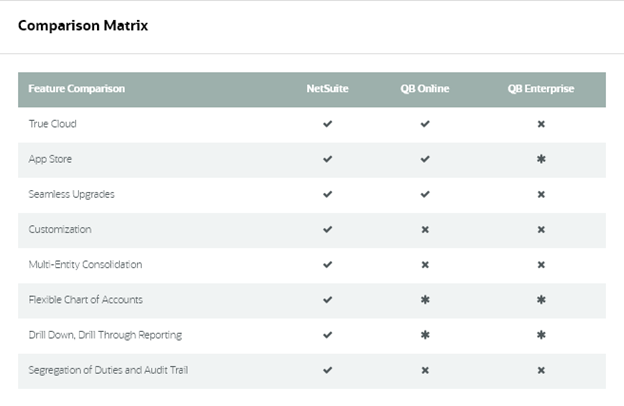

This chart shows a comparison of the features of NetSuite and QuickBooks.

QuickBooks Online: An Overview

QuickBooks Online is the starting point for many small businesses in need of bookkeeping software, thanks in part to its low price point. Users can track income and expenses, connect bank and credit card accounts, and create financial reports like income statements and balance sheet reports.

QuickBooks Online is a standalone, cloud-based product that is limited strictly to accounting.

QuickBooks Enterprise: An Overview

QuickBooks Enterprise is fundamentally a desktop program and doesn’t have a true cloud offering. Users can pay for a third-party hosting company to take it off-premise, but this adds yet another vendor to manage and doesn’t deliver all the benefits of the cloud. Inter-company transactions are manual at best and the opportunity for errors is abundant.

QuickBooks Enterprise does not automate or solve for a range of critical business processes like subscription billing, revenue recognition, asset management and multidimensional reporting. Enterprise users must resort to multiple point solutions with predictable difficulties including inconsistent reports, manual re-work, redundant processes and continually multiplying Excel sheets. QuickBooks Enterprise has some inventory management functionality, but it’s fairly limited and relies on third-party integrations for advanced features. Detailed reporting may require exporting spreadsheets and viewing data in and across multiple platforms.

QuickBooks Enterprise offers a traditional, hard-wired chart of accounts to minimize complexity. Unfortunately, this also limits the ability to capture transactions and organize them into your specific financial dimensions to track assets, liabilities, revenue and expenses.

NetSuite Overview

NetSuite’s financial management solution supports businesses at every stage of growth with a cloud-based, unified platform that provides real-time data with customizable fields and role-based dashboards. NetSuite offers an entire suite of business solutions beyond accounting to serve organizations looking to increase operational efficiency throughout the business: CRM, eCommerce, payroll and HR management software (HRMS), professional services automation and more. Since it is built for the cloud, it provides business data in real-time and requires no added IT infrastructure. No more worrying about what version you are on, as all users of NetSuite are on the same version of the software, which is another benefit of the cloud. No more waiting for an upgrade to enjoy new functionality. All users are always up to date on the same version and benefit from new features and functionality.

NetSuite works as an end-to-end accounting solution, enabling cash flow and revenue management, proper revenue recognition, automatic quote-to-order fulfillment and integrated planning and budgeting. It goes beyond basic bookkeeping and includes functionality that can reduce the need for additional headcount. It’s built to run your entire business.

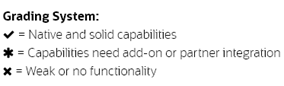

Source: TechValidate Survey 2021

Enable Economic Independence with NetSuite Revenue Management

Stop tracking financial data in multiple spreadsheets. NetSuite makes it easy to get your data out of spreadsheets so you can manage revenue recognition.

-3-

A Comparison of QuickBooks and NetSuite's Features

The two platforms may serve similar purposes and check off some of the same boxes, but a close comparison shows that there are as many differences as similarities, especially when it comes to the robustness and completeness of the feature sets.

For growing companies, depth of functionality has a direct effect on the time and resources required to complete finance tasks. A recent survey of NetSuite customers shows that superior features and functionality are the primary reasons why CFOs switch from QuickBooks to NetSuite.

Here are a few examples of how some of NetSuite’s key features compare to QuickBooks.

Revenue Recognition

Whether a sales transaction consists of a single action, a series of actions across a period of time or different types of deliverables in a bundle, NetSuite enables accounting teams to comply with revenue recognition requirements and schedule revenue to be recognized automatically. Financial statements and forecasts are accurate and updated in real-time.

This is especially helpful for software and service businesses dealing with multiple deliverables—such as upgrades, services delivered over time or additional licenses—that require accounting teams to recognize and defer revenue at different points in time. QuickBooks can construct clever workarounds for the limitations, but workarounds inevitably create a mess of manual journal entries, complicated recognition schedule spreadsheets, and unclear or nonexistent forward visibility.

Billing

Your organization can gain real-time visibility into billing and financial activity with NetSuite. This adds more transparency through consolidated invoicing, automated rating processes and support of multiple pricing models to capture setup fees, license counts and variable consumption in one step.

NetSuite’s billing capabilities truly outshine QuickBooks when it comes to subscription billing. Automated renewals help retain revenue and reduce the need for manual oversight. Businesses can also schedule subscription changes, removing the need to manually monitor and track them, and set customer-specific pricing and discounting.

NetSuite SuiteBilling can combine one-time product or service purchases with recurring services on a single bill; for example, a mobile phone, its activation fee and first month of service. SuiteBilling also supports multiple subscription billing options, including fixed rate (annual, multi-year and monthly), consumption-based or a combination. You can also manage promotional pricing, such as a discounted rate with adjusted automatic billing after free trial period, and easily modify contracts or put subscriptions on hold and restart.

General Ledger

NetSuite’s general ledger (GL) provides accounting data from a consolidated level down to individual subsidiaries and dimensions and down to the transaction level, allowing you to customize your GL to meet your business needs. You can add custom GL dimensions to transactions, such as invoices or vendor bills, across single or multiple accounting books, reducing the time and effort required for account reconciliation, period close and audit processes.

A simple chart of accounts with the added ability to track custom dimensions such as the cost center, department, location, etc. makes transactions easier to categorize and report on at the transaction level, removing the need to go through hundreds of lines in the chart of accounts to see what transactions should be coded to.

Multidimensional reporting eliminates the need for a complex chart of accounts, letting you add tracking details at the transaction level. QuickBooks tries to make its solution work with tags and classes, but there are a limited number which results in users trying to implement workarounds.

Accounts Payable

QuickBooks doesn’t provide any purchasing controls, but NetSuite’s approval workflow engine reduces risk by ensuring that purchasing and accounting controls and policies are followed using intelligent built-in workflows. This makes approvals easier in a time when people aren’t sitting next to one another—whether it’s because of multiple offices or a work-from-home environment. Users can automate discount calculation and exception processing when invoices do not match purchase orders, limiting manual data entry errors and decreasing the time it takes to process bills from vendors.

NetSuite helps enforce segregation of duties by controlling the data and functionality users have access to via role-based and user-based permissions. By comparison, QuickBooks has a limited approval workflow and a few user roles, which does not deliver a strong control environment and true segmentation of duties. For example, an accounts payable process that allows one person to generate, approve and pay a bill creates an environment that is ripe for embezzlement.

Accounts Receivable

NetSuite’s accounts receivable features allow you to manage your customer list, track your receivables and receive payment, all without needing to enter detailed debits and credits. Configurable dashboards, reports and KPIs provide a real-time view into accounts receivable data such as customer aging, invoice analyses, recurring invoices, deferred revenue and exception reports that flag account anomalies.

You can also offer customers self-service access to real-time insights on purchase orders, inventory levels and payment information via a customer portal. This simplifies the payment process with invoices by email with several payment options. QuickBooks can create journal entries, but it can’t handle downloads and schedules. NetSuite Advanced Revenue Management makes it easy to forecast and record revenue from contracts with milestone billing and a contract renewal feature. Forecasted revenue automatically converts to recognized revenue as performance commitments are completed.

Fixed Asset and Lease Management

You can manage an asset’s complete lifecycle and easily report on all fixed assets, tracking depreciating or non-depreciating company assets from creation to depreciation, revaluation and disposal. This makes it easier to document and maintain an accurate record of all capital assets, including acquisition costs and asset status.

NetSuite also addresses the new accounting and reporting requirements for leased assets, specifically setting up amortization schedules and splitting out interest expense from rental expense for reporting purposes on balance sheets and income statements, supporting multiple accounting treatments.

QuickBooks doesn’t offer you these fixed asset or lease management features.

Inventory Management

NetSuite inventory management gives your company clear visibility of your inventory. NetSuite inventory management minimizes manual processes by automating real-time tracking of inventory levels, orders and sales throughout the inventory lifecycle. It also provides insights needed to make data-driven decisions, maximize sales and gain greater control of your business. Warehouse management features like inventory counts, pick, pack and ship, integrated barcoding and multi-order picking are also available.

Reporting

QuickBooks and NetSuite both have standard accounting reports, such as P&L and cash flow. But NetSuite’s expansive library includes real-time reports, from revenue forecasting to consolidated parent and subsidiary reports. Thanks to NetSuite’s multicurrency feature, you can report using the local currency of the countries where subsidiaries are located.

NetSuite allows detailed drill-down and drill-across reporting for any record in the system with ease. NetSuite reports do away with static reporting, giving flexible views for reports from department, location, product line or any number of operational perspectives. With a few clicks, easily create a report with subsidiaries, departments, cost centers across the columns of a financial statement for deeper analysis.

Case Study:

A Nonprofit’s Switch from QuickBooks Online to NetSuite

Baltimore Youth Cycling (BYC) is a nonprofit organization that made the switch from QuickBooks Online to NetSuite. Explore the details and the benefits of their migration.

-4-

When is the Right Time to Make the Switch?

When considering if it’s time to upgrade from QuickBooks, think about both your current needs and scalability for the future. Will QuickBooks meet your needs during seasons of growth? Have you had to settle for performing certain tasks manually?

As your company grows and accounting becomes more complex, you’ll find that entry-level accounting software has clear limits. Not only that, but trying to find solutions that can extend the QuickBooks solution are often clunky. Handling mature business challenges using spreadsheets and clusters of disparate applications just doesn’t work—which is why companies often upgrade from QuickBooks to NetSuite.

So, if you answer yes to these three statements, it’s time to consider the switch:

- I need multiple add-ons to accomplish what I need for my business

- I’m using Excel spreadsheets to manage some of my organization’s data

- I’m entering data in multiple places

How to Know When to Upgrade Your Accounting System

Find out what to look for in a more powerful ERP system in this free webinar recording.

-5-

Where to Start With a New ERP System Implementation

If you’re interested in upgrading your accounting solution, you’ll need to outline your current processes and pain points, identify weaknesses in the current system, know what you want from the new system and do your homework to understand how both QuickBooks and NetSuite meet your business requirements.

Work with an outside ERP consultant who has significant expertise in the system you’re implementing. A good ERP consultant will work with you on the items above to help the implementation go smoothly and make sure it checks all the boxes for your business.

Our blog posts The One Big Thing that Will Make or Break Your ERP Implementation and What Does a New ERP Implementation Look Like? shed light on what a system implementation entails.

-6-

When You Should Choose NetSuite

As you grow, the number of customers increase, you hire more employees, process more data and require greater automation. You need an accounting software solution that boosts efficiency and serves as the foundation for your increasingly complex business.

And wouldn’t it be nice if you had one, fully integrated software system for your business? A system where information is entered once, then automatically flows everywhere it needs to go. Imagine that same system having the functionality to grow as you grow or allowing you to customize the system to your liking to meet every department’s need.

Unlike other systems you might have used, NetSuite has everything in a one-stop-shop solution–meaning core financials, plus a whole lot more functionality built-in that grows with you alongside your business.

Level Up Your Business Processes with NetSuite

Watch this on-demand webinar to discover how you can manage all your key business functions under one cloud-based system with NetSuite.

-7-

Where QuickBooks Falls Short

QuickBooks’ limitations mean businesses must layer on more systems or applications for specific purposes: revenue management, fixed assets, procurement, order management, billing, inventory management, services delivery and more. These add-ons mean more costs for you.

If these systems aren’t integrated, your finance staff must maintain half a dozen different applications and risk errors trying to transfer and consolidate data between different programs, each with its own configurations and end-to-end processes—and more than likely, you’ll have to add personnel to manage it all.

Meet The Author

Sharon Paul, CPA, MCTS

Partner

Helping clients use technology to solve tough business issues is what drives Sharon. If she can save a business valuable time by automating a procedure or process, or help them use technology to produce useful information for decision-making, then Sharon feels that she’s done her job. She specializes in NetSuite and helps businesses transition from one ERP system to another.

Transform How Your Business Uses Technology

If you're a privately-held business or nonprofit organization and want to use technology more effectively, let's talk.